Unleash the power of your internet banking with these top 3 hacks

If your relationship with your money is one of the most influential relationships in your life.

And the interface between you and your money is your internet banking.

Then the way you do your internet banking is critically important.

So how do you do yours?

Are you a passive user that doesn’t use the incredible features? Or are you a power user who leverages the features to get the benefits you deserve?

Wouldn’t it be nice if you could see your full financial status with one quick glance at your internet banking?

It’s the way you manage your money that determines your relationship with it. The actions you take and the results you get are a direct consequence of your point of view of you and your money.

So today I’m going to show you 5 epic ways you can hack your relationship with your money simply by creating an internet banking system that you are excited about!

Hack #1: Develop a positive relationship with your banking software.

Is it possible that you can manipulate your internet banking to change your point of view on your business and personal finances?

What kind of feelings do you get when you log on?

- Do you cringe?

- Do you feel neutral?

- Or do you smile?

You’d be amazed if you knew the ability / value / secrets / hacks of the software and interface your bank gives you for free!

Yeah sure you can rename your accounts and set up auto transfers. Everyone knows that. Or at least they should by now!

But did you ever consider that you can manipulate your relationship with your money and your life goals in an app that contains the one critical element crucial to all of you goals? Your money!

Think of it as a vision board built into your internet banking. You already know how a vision board works. So why not install the same psychology into your internet banking?

It’s certainly worked for me. For well over a decade I’ve been setting and achieving long and medium term goals with my banking software at the core of the process.

Anyone can do it. You can start the same process in less than an hour. So let me explain how…

Step 1: Open up at least 5 new free online saver accounts.

There might be a few options of savings accounts to choose from, but with interest rates at almost zero it doesn’t matter much which one you choose.

Step 2: Do a quick mind map or write a list and write down 20 big life goals.

You might only end up choosing 5 of them, but writing down 20 will enable you to choose a ‘collection of goals’ that compliment each other, which means you are more likely to get them all. See the mind map example below and use it as a template.

Step 3: Rename your 5 new accounts.

Every internet banking software I’ve tested (and I’ve tested the top 10 in Australia at least) have the ability for you to rename your accounts. So your task is to give each goal a name and use that name for your account. 3 words is probably your limit, so choose wisely.

Step 4: Set up small weekly payments to each of the new accounts.

Ideally these payment amounts should be as a percentage of your pay. But if that’s too complex for you and you want to keep it simple, then just pick a very small and long term sustainable figure.

Step 5: Show and tell your friends about these goals

Not only will this inspire other people, but it will enable you to ‘speak your goals out loud’ and in turn, program your subconscious and reaffirm the goals.

Its like putting an affirmations practice into your banking… which is a very good idea.

Where attention goes, energy flows and results show.

Use this mind map template to explore your big life goals.

Hack #2: Renaming and coding your accounts:

There's two types of internet bankers:

- The person who uses it because that’s where their money lives

- And the person who creates a bespoke experience that they come to love

Which one are you?

It’s free and easy to rename your accounts and takes only about 10 minutes to do...

Over the years, having a positive experience with your internet banking (the interface between you and your money) could mean the difference between financial frustration and money mastery.

So there’s a good chance that spending a few minutes renaming and building a custom experience could be one of the best investments of your time that there is.

Here’s a few examples that you might like:

- Rename your standard transaction account (where all of your discretionary spending takes place) your Life account. This is for the card you carry in your pocket and where things like Uber, coffees and drinks at bars come out of.

- Create a second account for all of your bills and recurring expenses. Call this account Fixed Expenses or Bills. Here is where your rent, utilities and gym membership etc come out of.

- Open up as many online savers as you have long term goals. They’re free so why not? Things like ‘Trip To Paris’, ‘New House’ and ‘New Summer Wardrobe’ might appeal. If you’re regularly putting a small but consistent amount of dollars into these accounts, then eventually you’ll get there - making you love your internet banking even more.

- Lots of people have savings accounts that are intended for investing. So why not rename the account as ‘Savings For Investing / Retirement’? This simple task can prevent you from stealing funds out of this account when things get tempting. And I know how often that happens and how bad it makes people feel.

- Have a ‘Travel’ or ‘Play’ account that is solely to be spent on fun stuff. Consider this to be a reward for all of the effort you put into your savings as above. Some people don’t allow themselves this kind of account and then they end up taking their fun money out of their savings. The price they pay for this is immeasurable. I go into this psychology a lot in my weekly online training. Click here to join us.

- If you have a credit card, you can rename it ‘Kill Me’ or ‘Pay off $50 per week’ or ‘Never Again’ etc. Program your mind to change your behavior simply by renaming the account with a name that inspires change! It’s even possible to figure out how much you need to pay, set that up on auto and hide the account from your home screen so it doesn’t make you feel bad all the time!

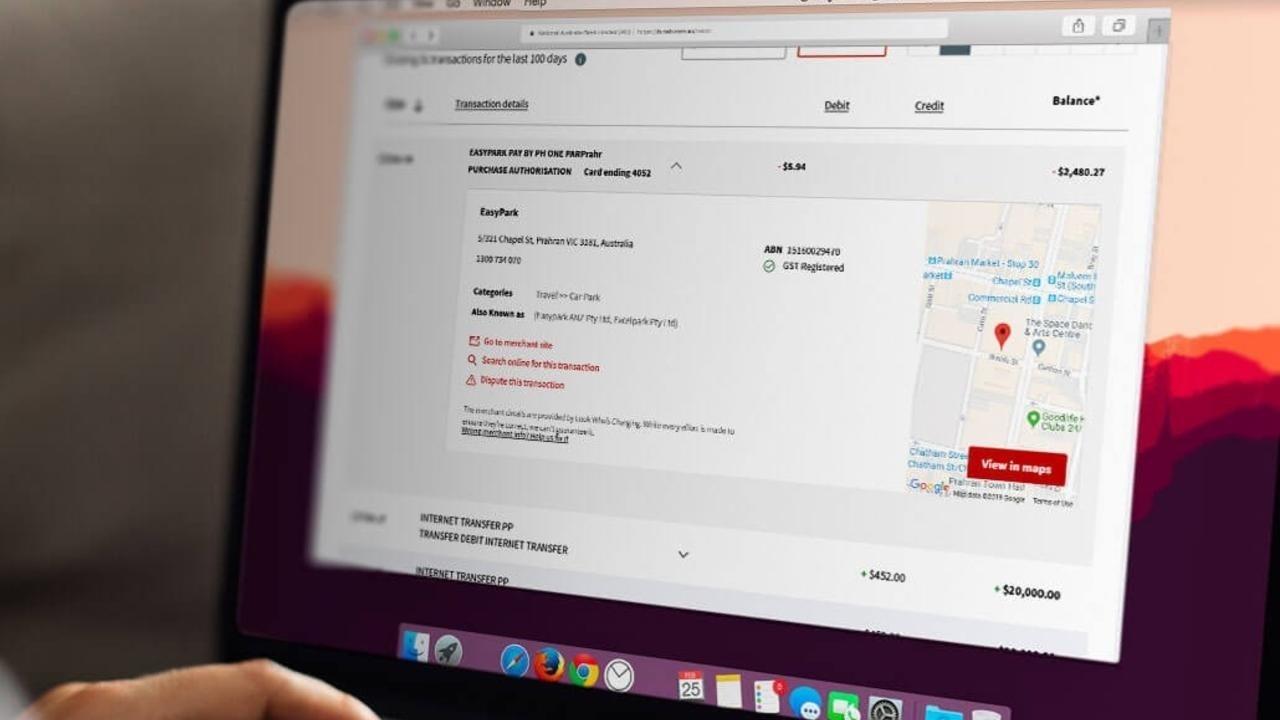

Hack #3: Making tax time a breeze

If you have a small business, then you will love this amazing hack!.

Let me show you how I leverage csv files to make tax time a breeze. But first it’s important to note that I use NAB for my banking and they offer all of their accounts for free. There’s no $5 monthly charge for a transaction account so I can open as many as I like.

With a well designed family of accounts you can segment your business spending into different accounts related to the primary areas of your business. This can usually be achieved with as little as 3 accounts. But there’s an advanced version too.

Let me explain. In the advanced banking system, you would have a collection of accounts for each of your incomes and expenses:

- Sales / income

- Marketing and advertising

- Transport

- Utilities

- Wages

- Profit

These accounts could be set up to automatically manage your business finances for you. That’s too complex to go into here today, but I’d be happy to explain it on a quick call.

Anyway, I digress…

When it comes to tax time, having this bank account structure will enable you to prepare your own tax with ease, as long as all of your business transactions are done through your banking that is…

All of the account activity for the past tax year can be downloaded very easily as a csv file. This simple action will enable you to filter and analyse all of your financial years transactions in a couple of hours. I made a video about this if you want to see it in action.

This is the system I have been using to manage my two businesses for the past 10 years. It takes me around half a day and enables me to see in fine detail the finances of my businesses and the profit and costs that I incur.

For me, being able to analyse and prepare my finances for my accountant is of very high importance. I pity the business owner who doesn’t intimately know their businesses numbers down to the dollar. Warren Buffet and Sam Walton (Walmart) would scold you from here to breakfast!

So maybe this financial year could be a lot easier for you.

Segment your business finances and build out an internet banking system to manage your money for you.

It’s free, easy and could save you countless dollars, hours at tax time and multiple stressful nights.

Key points to action:

- Acknowledge the critical role your internet banking experience has on your finances, and subsequently your whole life.

- Take some time to explore what’s possible and take advantage of the renaming and segmentation aspects of setting up a bespoke system for your life

- Finally, use your banking as a financial vision board for the big and small goals in your life. It’s a rare goal that doesn’t require money, so leverage the power of your banking software to design and achieve a better future.

This article explains only 3 of the 12 spectacular features of the Smart Banking System that we teach here at Master Your Money.

If you’d like to know more you can schedule a discovery call or register for our next weekly live training (both options are free!).